September 2023 Real Estate Market Update

September 2023 Market Update:

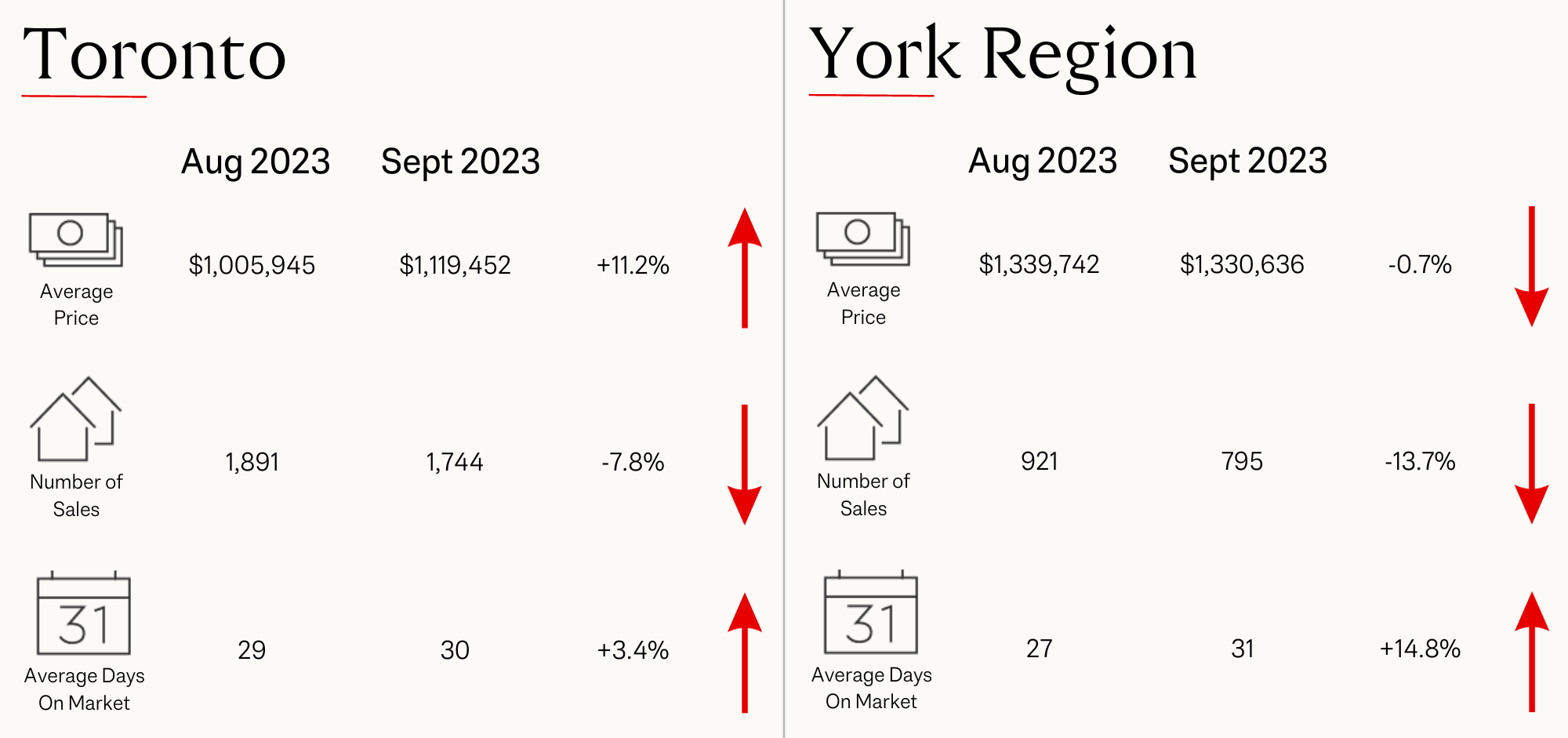

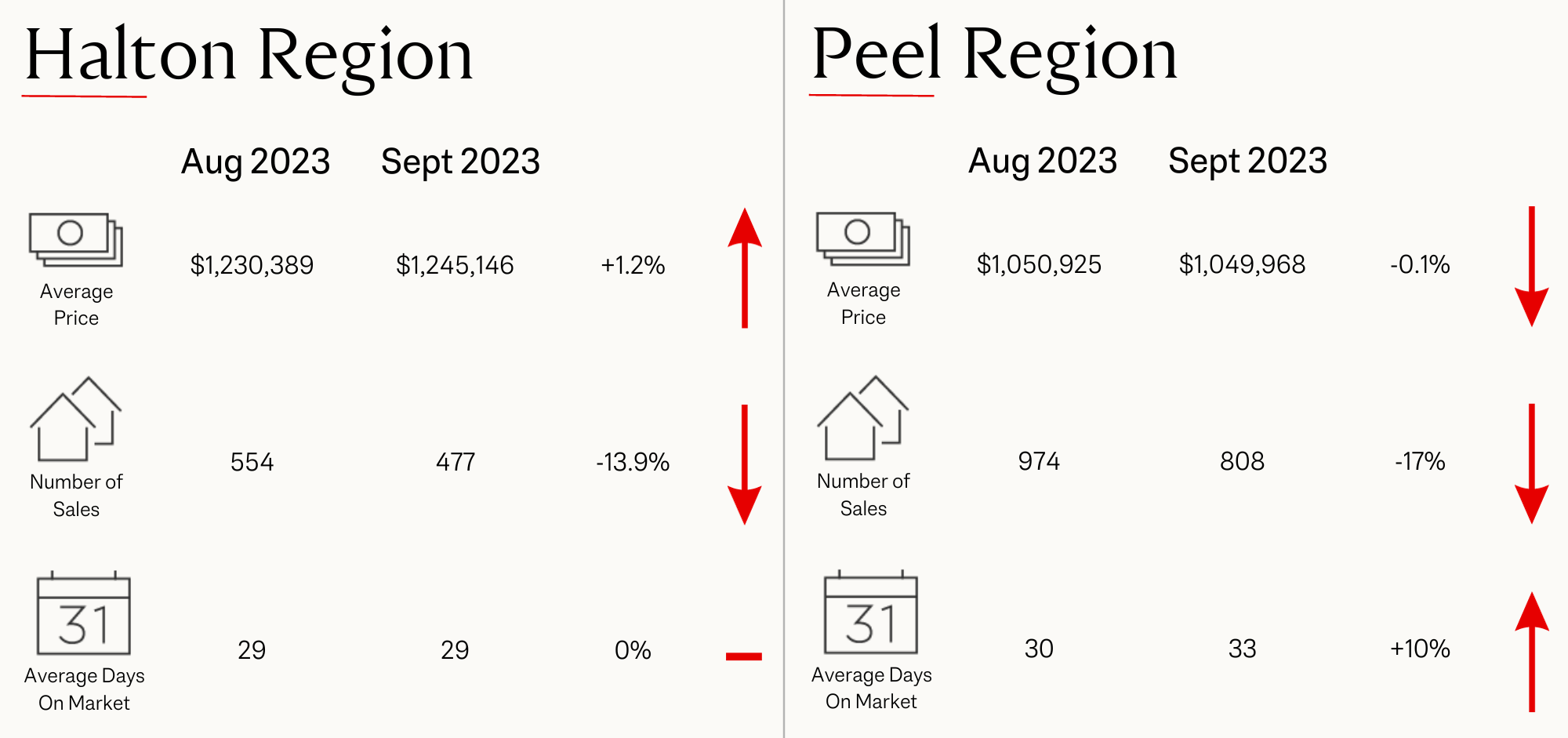

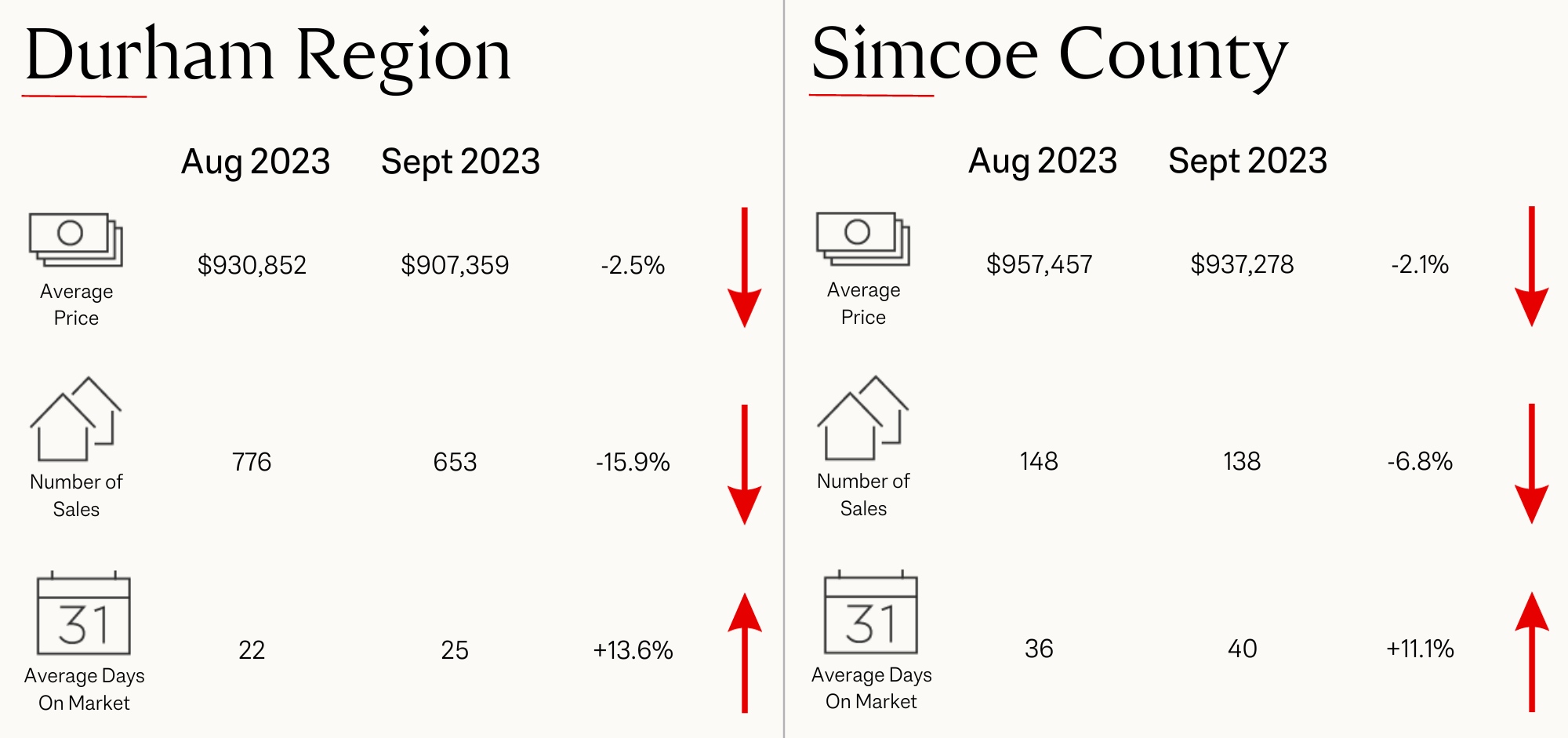

The Greater Toronto Area real estate market continued to slow in September due to a variety of reasons. High borrowing costs, high inflation, slower economic growth, and uncertainty regarding monetary policy are all major factors that continue to weigh down the GTA housing market.

September saw an increase in the number of new listings compared to August, and a drastic increase compared to the record low in September 2022. Historically, due to more activity in the real estate market in the fall, this is generally expected. However, the number of sales did not increase with the number of new listings. Sales are down in all GTA market areas in September 2023. Less sales and more listings is resulting in more options for buyers and more days on market. Despite the increase in inventory, average selling prices have been steady over recent months, and are actually up 3 percent compared to the same time last year.

In the short term, buyers are experiencing more negotiating power and sellers are having a more difficult time selling compared to earlier this year. This trend is expected to continue into the winter and possibly the spring, as interest rates are projected to remain steady or slightly increase in the next couple of months. Looking past this, experts predict that the interest rate will begin to lower in mid-2024. As the interest rate lowers, we will likely experience an uptick in demand for homeownership during the second half of 2024.

For those that are looking to make a move, now might be the right time. With more inventory comes more choice and an overall upperhand for buyers. Buyers may be able to negotiate longer closings and favorable terms and conditions that can assist with selling in this market, if you must sell before you buy. This is also a great time for first time buyers to get into the market. With much more inventory and much less competition compared to earlier this year, first time buyers are able to secure favorable terms and fair prices. Although interest rates are high, prices are expected to increase considerably as interest rates come down. With many short term mortgage products available, buyers can cope with the high rates for a short period of time, but reap the benefits of a lower purchase price. It is important to note that the purchase price is permanent, but the interest rate is only temporary.

To see how prices have been affected in your area, please click the link below to get access to TRREB's September Market Statistics for all areas in the GTA. The stats are broken down by average sales price, number of homes sold, number of new listings, and average days on market for each property type; detached, semi-detached, townhouses, and condos.

If you want to know how the latest market changes affect your real estate plans, you can book a call with me by clicking the link below.

https://calendly.com/

Categories

Recent Posts